The global pharmaceutical CDMO (Contract Development and Manufacturing Organization) market was valued at USD 146.0 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% between 2024 and 2030. This growth is primarily driven by increasing investments in drug development by CDMOs and the rising demand for novel therapies. Other key contributors include heightened pharmaceutical RD spending, growing demand for genetic drugs, the prevalence of cancer and age-related disorders, and the escalating need for advanced therapeutic solutions.

Additionally, the increasing adoption of biosimilars, biologics, personalized medicine, orphan drugs, companion diagnostics, and adaptive trial designs is further fueling demand for CDMO services. As pharmaceutical companies push the boundaries of innovation, the necessity to comply with stringent regulations is intensifying the reliance on specialized CDMO providers adept at navigating complex development and manufacturing processes.

Key Developments in the Industry:

The market's expansion is also influenced by strategic initiatives within the sector. For example, in January 2022, Lonza collaborated with HaemaLogiX to manufacture the monoclonal antibody drug KappaMab for myeloma treatment. In December 2023, Innovent Biologics extended its licensing agreement with Synaffix, part of Lonza, to advance ADC (Antibody-Drug Conjugates) technologies. Such collaborations highlight the role of biopharmaceutical innovations in accelerating market growth.

Gather more insights about the market drivers, restrains and growth of the Global Pharmaceutical CDMO Market

Speed and innovation are critical factors for pharmaceutical companies, especially small and specialty players, who increasingly depend on third-party providers like CDMOs. Many CDMOs adopt a one-stop-shop approach, managing everything from API development to dosage formulation, encompassing early development stages through to commercialization. To meet these diverse needs, CDMOs must possess specialized capabilities and advanced technologies tailored to address specific challenges in drug development and manufacturing.

There is a rising willingness among pharmaceutical companies to invest in reliable and high-quality CDMO services. Major players aim to streamline operations by integrating multiple processes across the value chain, encouraging CDMOs to offer comprehensive solutions. This seamless integration allows pharmaceutical companies to manage operations efficiently while minimizing supplier interactions.

Pharmaceutical CDMO Market Regional Insights

North America:

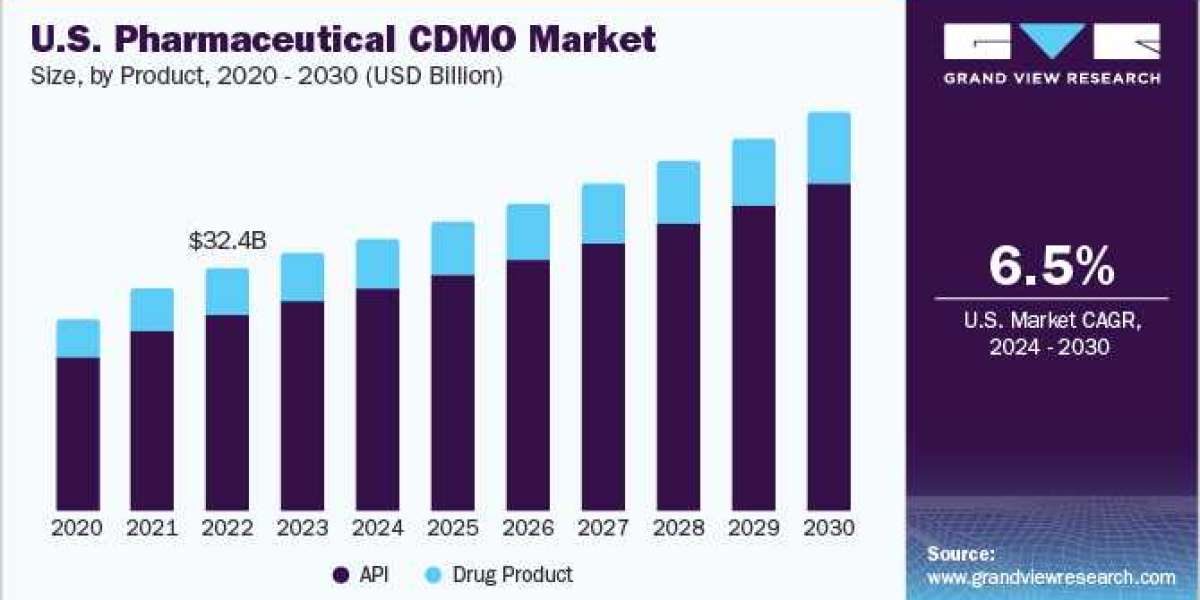

North America is anticipated to grow at the fastest CAGR of 6.5% during the forecast period, driven by significant investments in RD and the growing pharmaceutical industry in the U.S. and Canada. The region's stringent regulatory requirements necessitate specialized compliance expertise, making CDMOs indispensable partners for pharmaceutical companies. The U.S. dominated the market in 2023, with CDMOs expanding their services to meet the surging demand. For instance, in May 2023, CordenPharma initiated synthetic oligonucleotide manufacturing in Colorado.

Europe:

The European pharmaceutical CDMO market is expected to grow significantly due to increasing pharmaceutical activities and the growing trend of outsourcing manufacturing services. Germany led the region in 2023, benefiting from market consolidation, which enhances operational efficiency and competitiveness. The UK is forecasted to exhibit the highest growth rate, with established players like Lonza Group and Piramal Pharma Solutions driving market expansion.

Asia Pacific:

With the largest revenue share of 37.64% in 2023, the Asia Pacific market is propelled by improving economic conditions, enhanced insurance schemes, and growing manufacturing capabilities in countries such as China, India, and Singapore. In China, strategic partnerships like the one between Chime Biologics and Kings Pharm in 2023 are boosting market growth. Meanwhile, Japan and India are expected to grow rapidly due to advancements in drug delivery technologies and the cost advantages offered by these regions.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- Healthcare Testing, Inspection And Certification Outsourcing Market: The global healthcare testing, inspection and certification outsourcing market size was estimated at USD 5.92 billion in 2024 and is anticipated to grow at a CAGR of 8.89% from 2025 to 2030.

- Healthcare Companion Robots Market: The global healthcare companion robots market size was estimated at USD 2.09 billion in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2030.

Key Player Strategies

Leading CDMO companies focus on inorganic growth strategies, including mergers, acquisitions, partnerships, and joint ventures, to expand market presence and revenue. Initiatives such as service launches and facility expansions help these companies strengthen their competitive edge, further contributing to overall market growth.

Key Pharmaceutical CDMO Companies:

- Lonza

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Laboratory Corporation of America Holdings (LabCorp)

- Catalent, Inc.

- WuXi AppTec, Inc.

- Samsung Biologics

- Piramal Pharma Solutions

- Siegfried Holding AG

- CordenPharma International

- Cambrex Corporation

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Sequens

- EuroAPI

- Hovione

- Axplora

- Curia

- Dottikon

- Almac

- FIS - Fabbrica Italiana Sintetici S.p.A.

- Evonik

- Carbogen Amcis

- Farmhispania

- Uquifa

- AjiBio

- Pfizer Centre One

- Fareva

- Sterling

- Veranova

Order a free sample PDF of the Pharmaceutical CDMO Market Intelligence Study, published by Grand View Research.