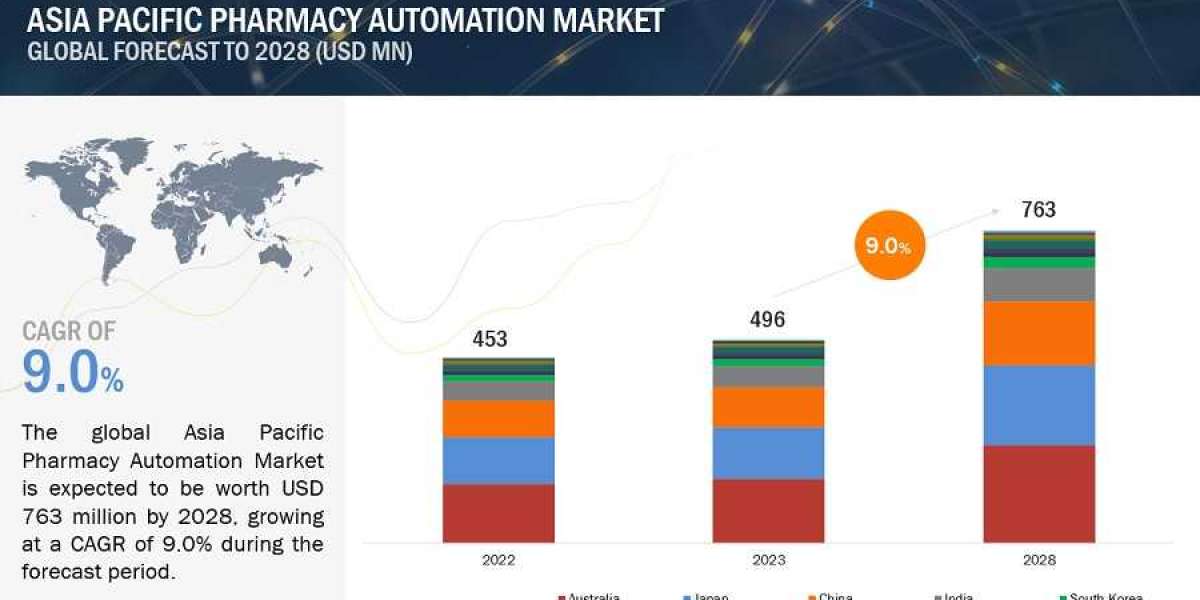

The global Asia pacific pharmacy automation market in terms of revenue was estimated to be worth $496 million in 2023 and is poised to reach $763 million by 2028, growing at a CAGR of 9.0% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The significant growth potential in emerging markets such as China, India, Japan, Singapore, India, growing focus on automation to reduce labour costs, and increasing speciality drug dispensing are some of the critical factors offering opportunities to the market.

However, lack of technical expertise and high cost of implementation are key factors challenging the growth of the Asia Pacific pharmacy automation market.

Download the PDF Brochure at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=78115984

Prominent companies in this market include Becton, Dickinson and Company (BD) (US), Yuyama Co., Ltd/Yuyama Mfg Co., Ltd (Japan), Omnicell, Inc. (US), KUKA AG (Swisslog Healthcare) (Germany), TOSHO Co, Inc. (Japan), Oracle Corporation (US), TouchPoint Medical Solutions (US), Takazono Corporation (Japan), Capsa Healthcare (US), ARxIUM, Inc. (US), Mckesson Corporation (US), ATS Corporation (Canada), ScriptPro LLC (US), Hanmi Pharma Co., Ltd. (South Korea), NIHON CHOUZAI Co., Ltd. (Japan), and GETECH (Singapore).

The ecosystem market map of the Asia Pacific pharmacy automation market comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. The end users of pharmacy automation solutions include inpatient hospital pharmacies, outpatient pharmacies, retail pharmacies, benefit organizations, and mail-order pharmacies. The manufacturers of pharmacy automation solutions include the organizations involved in the entire process of research, product development, optimization, and launch.

Centralized pharmacies segment accounted to hold a significant share of asia pacific pharmacy automation industry, by application/operation

Centralized pharmacies segment accounted to hold a significant share of asia pacific pharmacy automation market, by application/operation. The growth of this segment is accounted to the advantages offered by these type of systems such as reduced inventory costs, streamlined workflows, and reduced expenses. The growing need to optimize inventory levels to reduce stock-outs, minimize errors related to manual stocking, and improve drug shortage management is a key factor driving the growth of this segment.

Acute care systems segment accounted for a considerable share in the Asia Pacific pharmacy automation industry, for inpatient pharmacies, by type in 2022

In 2022, the acute care systems segment accounted for a considerable share in the Asia Pacific pharmacy automation market, for inpatient pharmacies, by type. The large share of this segment can be attributed to the minimized losses associated with pilferage, misuse, and other missing charges by using automated pharmacy systems. Also, most healthcare insurers cover expenses for acute care services provided at hospitals. Hence, with the expanding insurance coverage across Asian countries, the workload in acute care systems is expected to increase and drive health service utilization. Consequently, the demand for better pharmacy management will grow and support the adoption of automation in acute care.

Direct Purchase at https://www.marketsandmarkets.com/Purchase/purchase_reportNew.asp?id=78115984

Australia dominated the Asia Pacific pharmacy automation industry in 2022

Australia accounted for the largest share of the Asia Pacific pharmacy automation market. The large share of Australia can be attributed to the developed infrastructure and growth in the demand for digitalized technologies across the country drive the implementation of different analytical solutions among pharmacies. Additionally, the presence of well-equipped hospitals and other healthcare facilities further drives the demand for and adoption of advanced solutions such as pharmacy automation systems in Australia.