The global biochar market was valued at USD 541.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. The primary drivers of market growth include the increasing use of biochar in organic food production, as well as its ability to improve soil fertility and promote plant growth. The European Biochar Certificate has enacted regulations supporting the direct application of biochar to soil in countries like Austria and Switzerland. Biochar is produced through the controlled heating of waste materials such as agricultural, wood, forest waste, and animal manure. Among its applications, biochar is widely used as a soil amendment to reduce pollutants, prevent soil leaching, retain moisture, and reduce fertilizer runoff.

Factors such as growing environmental awareness, lower raw material costs, and supportive government policies for waste management are expected to provide further opportunities for market expansion. The biochar industry consists of both organized and unorganized sectors, with a strong presence of large-scale manufacturers and an increasing number of small and medium-scale producers, particularly in North America and Europe. However, regions such as Asia-Pacific and the Middle East are projected to grow at a slower pace due to limited awareness of the product and its long-term benefits. The production of high-quality biochar requires significant capital investment, leading some companies to exit the market in recent years.

Gather more insights about the market drivers, restrains and growth of the Global Biochar Market

In rural areas of countries such as China, Japan, Brazil, and Mexico, biochar production is often carried out in collaboration with research institutions. The number of organized industry players producing high-quality biochar is expected to increase due to rising demand for organic food. The full potential of biochar has yet to be realized outside of the agricultural sector. Beyond agriculture, biochar is also used as a fabric additive in the textile industry, as a raw material for building materials, and as protection against electromagnetic radiation in the electronics industry.

The growing demand from the food sector is projected to be a key factor in driving market growth. The use of biochar in water treatment is also expected to become an important application in the near future, particularly with the increasing need for water treatment facilities in emerging economies. Furthermore, the production of biochar using biogas and crop residue is likely to complement market growth. Raw materials for biochar production, such as wood waste, forest waste, agricultural waste, and animal manure, are mainly sourced from the wood and forest-based product sector.

Major suppliers of wood pellets and residues to biochar manufacturers include companies like Georgia-Pacific, Weyerhaeuser, and West Fraser. Regulatory authorities such as the EU Commission and the U.S. Environmental Protection Agency (EPA) oversee the market, with rules concerning the use of biochar in agricultural production and waste management. New regulations have been introduced by the U.S. EPA regarding biochar production, and by the EU Commission regarding its manufacturing and use. Since biochar technology is still in its early stages, there are significant opportunities for developing blended biochar products in the future.

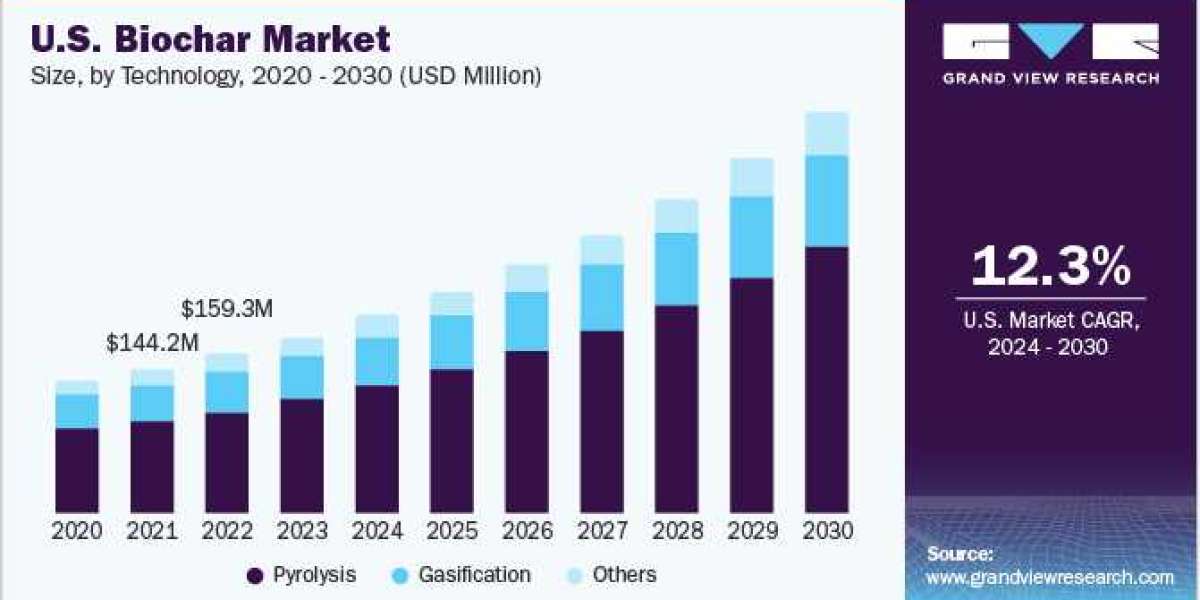

Technology Insights

The biochar market is categorized by technology into pyrolysis, gasification, and other processes. In 2023, pyrolysis dominated the market, accounting for over 65.1% of total revenue due to its high yield of biochar with stable carbon content. Pyrolysis is favored for its reliability in producing biochar that can be used in agricultural applications. Gasification, which has been used for electricity generation, is expected to lose market share during the forecast period due to its lower biochar stability. Other processes such as hydrothermal carbonization, acid hydrolysis, and cooking stove methods are used by small-scale producers seeking higher profitability. Asia-Pacific has experienced growth in the use of these alternative processes due to the increasing number of small-scale producers in the region.

Application Insights

Agriculture was the leading application segment in 2023, accounting for over 77.0% of the market's revenue. Biochar is valued in agriculture for its ability to enhance water and fertilizer retention and improve soil fertility, leading to better crop nutrition and growth. However, many farmers are still unaware of the benefits of biochar. General farming within the agricultural sector is expected to see significant growth, driven by efforts from research groups and institutions to raise awareness about biochar among farmers. Livestock farming is also a major area of biochar use, where its ability to provide essential nutrients and promote animal health has increased its application in poultry, cattle, and meat production.

Government support for organic farming is expected to create substantial growth opportunities in the biochar market. Beyond agriculture, biochar is being used in water and waste treatment applications, particularly in emerging economies such as China and India, where the need for advanced water infrastructure and hygiene is growing.

The increasing demand for organic food, rising health consciousness, and greater consumer spending are boosting the organic farming sector, complementing biochar market growth. However, conventional farming remains common in many rural areas due to its higher yields. The use of biochar in mixed farming, zero-tillage farming, and biodynamic agriculture is expected to grow significantly, supported by initiatives from governments and private institutions.

Order a free sample PDF of the Biochar Market Intelligence Study, published by Grand View Research.