The global advanced ceramics market size was estimated at USD 107.00 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. Increasing demand for advanced ceramics in various industries, coupled with growth in the medical and telecom sectors, is expected to drive market expansion. Advanced ceramics, also known as technical ceramics, possess improved magnetic, optical, thermal, and electrical conductivity. End-users can reduce their production and energy costs by utilizing advanced ceramics that provide high efficiency to end products. Asia Pacific is a leading market for advanced ceramics in the world in terms of their consumption.

The rise in demand for advanced ceramics in the U.S. can be attributed to an increasing preference for lightweight materials across various industries. The production and consumption of these materials and components for the electrical and electronics sectors have been on the rise due to the growing need for uninterrupted connectivity. Furthermore, flourishing electric vehicle (EVs) and defense sectors have also contributed to market growth.

For instance, in 2023, under the National Defense Authorization Act of the U.S., the country authorized USD 32.6 billion for Navy shipbuilding, an increase of USD 4.70 billion. Also, in April 2023, the EPA announced new and stricter environmental rules for light- and medium-duty vehicles. The rules are expected to apply to vehicles manufactured from 2027 to 2032, covering greenhouse gases (GHG) and other pollutants, including ozone, nitrogen oxides, particulate matter, and carbon monoxide.

Gather more insights about the market drivers, restrains and growth of the Global Advanced Ceramics Market

Material Insights

The alumina material segment held the largest revenue share of over 34.0% in 2023 and this trend is anticipated to continue over the forecast period. Alumina-based advanced ceramics are used for harsh applications that need characteristics, such as thermal stability and wear resistance. Some of the applications include high-voltage semiconductor parts, mechanical seals, insulators, and ballistic armor.

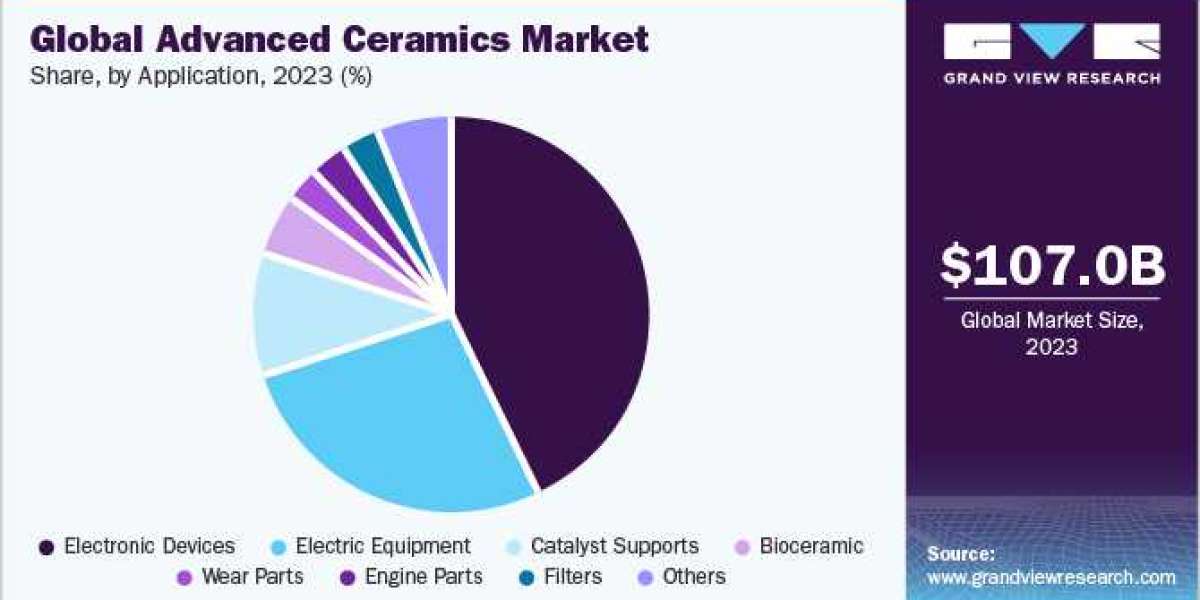

Application Insights

The electronic devices segment held the largest revenue share of over 47.0% in 2023 and this trend is expected to continue over the forecast period. The product is extensively used in computers, television sets, smartphones, and consumer appliances. Rising investments in the electronics sector are expected to drive growth in the segment over the forecast period.

Product Insights

Monolithic held the largest revenue share of over 78.0% in 2023 and is expected to dominate the market throughout the forecast period. The product's high-temperature resistance, reliability, and durability make it a vital component in both electronic devices and vehicles. Its exceptional characteristics ensure the best performance and longevity, thereby enhancing the overall quality of end products.

End-use Insights

The electrical and electronics end-use segment held the largest revenue share of over 56.0% in 2023 and is anticipated to dominate the market over the forecast period. Advanced ceramics possess superconducting, semiconducting, piezoelectric, and magnetic properties. They have various applications in the electrical and electronics industry, including spark capacitors, plugs, inductors, resistors, and circuit protection devices.

Regional Insights

The advanced ceramics market in North America held a revenue share of over 28.0% in 2023 of the global market. Flourishing electronics, medical, and EV industries in the region are expected to stimulate market growth. Growing requirements for high-quality semiconductors that carry out ultra-high frequency signal transmission to ensure improved connectivity are further expected to boost the market growth.

Browse through Grand View Research's Advanced Materials Industry Research Reports.

- White Cement Market: The global white cement market size was estimated at USD 9.43 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030.

- Cable Management System Market: The global cable management system market size was valued at USD 23.5 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030.

Key Advanced Ceramics Company Insights

Some of the key players operating in the market include Kyocera Corp. and CoorsTek.

- Kyocera Corp. is a multinational electronics and ceramics manufacturer based in Japan. Its advanced ceramics division offers a wide range of products, including cutting tools, industrial components, and electronic devices. Kyocera's advanced ceramics are known for their high quality, durability, and performance, making them a preferred choice in industries, such as automotive, aerospace, and medical

- CoorsTek is a privately owned manufacturer of technical ceramics based in the U.S. It produces a diverse range of advanced ceramic products, including components for semiconductor manufacturing, medical devices, and industrial equipment

Nexceris and Admatec are some of the emerging market participants in the advanced ceramics market.

- Nexceris is an advanced materials company dedicated to developing innovative ceramic technologies for energy, environmental, and industrial applications. Headquartered in the U.S., Nexceris specializes in the design and manufacture of ceramic-based products including solid oxide fuel cells, gas sensors, and catalysts. Leveraging its expertise in materials science and engineering, Nexceris aims to address critical challenges in clean energy and environmental sustainability

Key Advanced Ceramics Companies:

The following are the leading companies in the advanced ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AGC Ceramics Co., Ltd.

- CeramTec GmbH

- CoorsTek Inc.

- Elan Technology

- KYOCERA Corporation

- Morgan Advanced Materials

- Murata Manufacturing Co., Ltd.

- Nishimura Advanced Ceramics Co., Ltd.

- Ortech Advanced Ceramics

- Saint-Gobain

Order a free sample PDF of the Advanced Ceramics Market Intelligence Study, published by Grand View Research.